- #How do i save on turbotax free online file upgrade

- #How do i save on turbotax free online file full

- #How do i save on turbotax free online file software

- #How do i save on turbotax free online file plus

- #How do i save on turbotax free online file professional

TurboTax Premier costs $89 plus $49 per state return and it includes everything offered in the Deluxe package with a few more bells and whistles.

It’s meant for those who want to maximize deductions and credits with a professional’s help. These options are best for those who own a home and have children or dependents, prefer a bit more tax expert help, or even those who have experienced some sort of major life change and have questions. TurboTax Live Deluxe adds in tax expert assistance for $119 plus $54 per state return.

#How do i save on turbotax free online file software

Their software searches for deductions and credits you qualify for (their website touts 350+deductions) and it also maximizes your mortgage deductions and deducts your eligible charitable contributions. TurboTax Deluxe, which costs $59 plus $49 per state return, offers everything included in the TurboTax Free package. The tax expert assisted version of TurboTax Free is called TurboTax Live Basic, which costs $79. Unfortunately, you get upgraded to a fee-based option if your situation goes much beyond having a W-2 or other extremely basic circumstances. You’ll also get audit support if you need it. Thankfully, it’s easy to use and fast if you snap a photo of your W-2. TurboTax Free is the cheapest option, but it’s only for people with the simplest tax situations. Be prepared for price increases as the tax deadline nears. Expect deals early on in filing season to lure customers in. TurboTax’s pricing may change throughout tax season. Provides guidance and one-on-one help for contractors, freelancers, and small business owners looks for industry-specific deductionsĮxtra coaching to help self-employed people maximize tax deductions creates W-2s and 1099s for employees and contractors helps you figure out which startup expenses are deductible Personalized advice to help maximize next year’s refund additional help for investments, rental properties, and refinancing retirement tax help Includes investments, automatic import of investment income, rental properties, and cryptocurrency gains and losses One state included but e-file costs extra, $45 per extra stateĪdditional help on 350+ tax deductions and credits deductible feature included to help you value donated items Prep, print, and e-file your return, import financial dataĪdditional help on 350+ tax deductions and credits helps maximize property tax, mortgage, and charitable contribution deductions

#How do i save on turbotax free online file full

Note that all prices are the full listed price, but TurboTax occasionally runs discounts. Here’s a quick breakdown with a detailed explanation below.

#How do i save on turbotax free online file professional

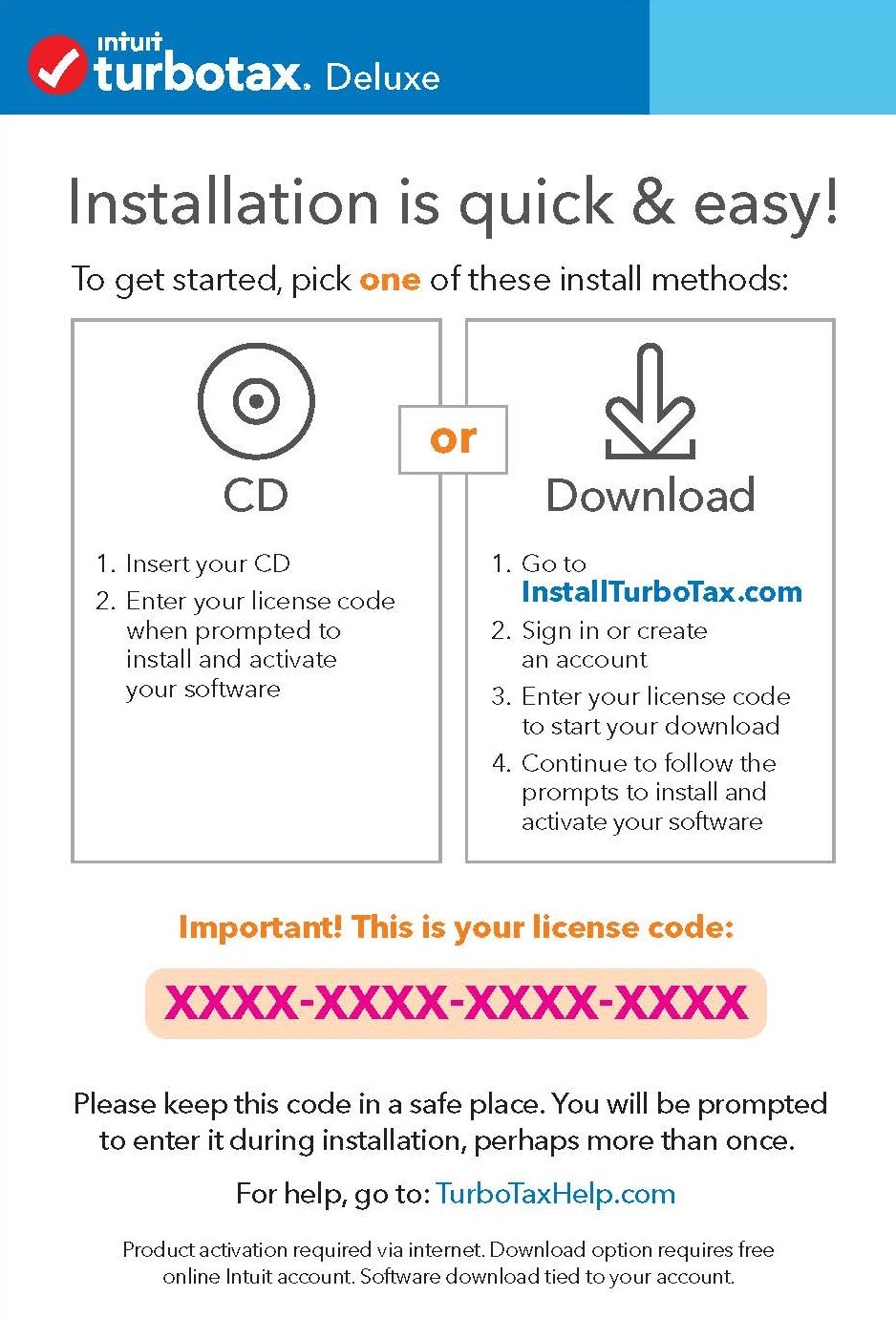

The self-serve and tax expert assisted options are the same as the online option except for the professional help. The online options are further divided into a self-serve version and a tax expert assisted version. TurboTax’s products are divided into online options and a desktop-based downloadable software which can also be purchased at brick-and-mortar retailers. Some desktop packages come with one state tax software but not e-filing. The level of tax-related services and bonus features you get access to depends on which option you select. TurboTax offers four tiers of pricing in three different sets of options. They cannot create new deductions or credits or make you eligible for tax benefits you don’t qualify for. Every service should, in theory, prepare your tax return optimally based on your situation. Many tax preparation services and software claim to get you the maximum refund. Read on to find out if TurboTax is the best choice for you, and make sure to check out our other picks when it comes to the best tax software programs to use before you file.

#How do i save on turbotax free online file upgrade

Note, however, that the tax professional can’t represent you or provide legal advice unless you upgrade to a paid service. It also guarantees the largest refund or smallest tax amount due based on your circumstances, and it offers audit support from tax professionals all year long. While we don’t recommend going toe-to-toe with the IRS, for beginners, this is a major plus. TurboTax guarantees accuracy or they’ll pay your IRS or state penalty and interest charges due that are caused by a TurboTax calculation error. You just snap a photo of your W-2 and the information automatically populates. While you’ll usually need to input your tax forms on a desktop or laptop, certain versions of TurboTax may allow you to input your tax forms by using your smartphone. All you need to do is select the characteristics that apply to you (e.g., if you have kids, work a W-2 job, or pay rent) and TurboTax automatically suggests the best tax package for your needs at relatively affordable prices. If you’re confused when it comes to doing your taxes, even if they’re fairly straightforward, then using TurboTax is a solid DIY option.

0 kommentar(er)

0 kommentar(er)